QuickBooks Online users can choose QuickBooks Live Bookkeeping to get year-round access to verified experts who are focused on their success. From the start, business owners can get personalized answers to questions and spend less time on their books. Accountants provide a higher level of financial analysis and planning. They may use the financial data bookkeepers generate to advise business owners on tax planning and budgeting.

Bookkeeping software and systems should be able to identify potential tax deductions and make any procedure related to reporting and filing taxes as seamless as possible. Managing income and expenses closely and in a structured format will make it much easier to prepare taxes—whether independently or with a tax preparer. Let’s review some tasks involved in bookkeeping, especially as they relate to your business’s day-to-day operations. But Dori Eversmann, owner of bookkeeping practice Chastain Partners, believes small-business founders are fully capable of managing their own books, especially if cost is an issue starting out. Once you’ve got a handle on how to begin bookkeeping for your small business, it’s time to set yourself up for success with an ongoing bookkeeping system. Small businesses often work with tax advisors to help prepare their tax returns, file them and make sure they’re taking advantage of small-business tax deductions.

Plan Ahead for Taxes

Accounting software eliminates a good deal of manual data entry, making it entirely possible to do your own bookkeeping. However, it can be difficult to catch up if you fall behind on reconciling transactions or tracking unpaid invoices. Regardless of your small business’s complexity, bookkeeping will still take time out of your week, so be sure you have the resources before committing to handling it yourself.

- Do you have more questions about the bookkeeping process for small businesses?

- Bookkeeping becomes more difficult when business transactions are lumped together with personal activity.

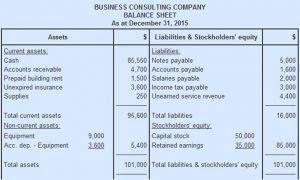

- They will also often help businesses produce crucial financial statements such as the profit and loss statement and balance sheet.

- You may also find invoicing and payroll software beneficial for multiple reasons, including for logging your inbound and outbound transactions.

- If you’re nervous about setting up accounting software for the first time, Kashoo’s experts can talk you through it.

If QuickBooks Online has too many features for your needs but you still want QuickBooks’s stellar reporting, QuickBooks Self-Employed might be a better fit. It starts at $15 a month and includes access to limited reports, plus freelance-specific features like mileage tracking and easy syncing with TurboTax. Bookkeeping is largely concerned with recordkeeping and data management. Bookkeepers make sure the information in the books is accurate and that the books are reconciled each month. Only an accountant licensed to do so can prepare certified financial statements for lenders, buyers and investors.

FAQs on Small Business Bookkeeping

Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Look at the item in question and determine what account it belongs to. For example, when money comes from a sale, it will credit the sales revenue account. Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software.

Best Accounting Software For Small Business 2024 – Forbes Advisor – Forbes

Best Accounting Software For Small Business 2024 – Forbes Advisor.

Posted: Mon, 29 Apr 2024 17:20:00 GMT [source]

QuickBooks Live Bookkeepers can help you streamline your workflow, generate reports, and answer questions related to your business along the way. One of the most important aspects of financial transactions is recording them accurately. This involves keeping track of all the money that comes in and out of a business. Accounts receivable (AR) is the money your customers owe you for products or services they bought but have not yet paid for. It’s important to track your AR to ensure you receive payment from your customers on time. An accounting ledger is a book or system you use for recording and classifying financial transactions.

What Is Bookkeeping? Definition, Tasks, Terms to Know

These days small business owners use one of the many computer bookkeeping or accounting software programs available to record financial transactions. Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity. Many bookkeeping software options automate the tracking process to eliminate errors. If not done at the time of the transaction, the bookkeeper will create and send invoices for funds that need to be collected by the company. The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable). When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account.

A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly. After you have a bookkeeping bookkeeping for small business system in mind, the next step is to pick an accounting software. Spreadsheets, such as Microsoft Excel, can be used for simple bookkeeping. More commonly, entrepreneurs use comprehensive accounting software like QuickBooks that can handle a larger volume of transactions and provide a deeper analysis.